In this article, you’ll learn ten proven strategies to improve the AECB credit score in 2025.

The Al Etihad Credit Bureau (AECB) tracks how responsible you are with money: paying bills on time, carrying big balances, or bouncing payments.

They gather all that data into a single score that tells lenders how big of a risk you might be. The AECB Credit Score

A good AECB credit score opens up many opportunities and allows you to access credit easily when you need it.

We live in a place where everything moves fast, and opportunities come knocking more often than not. That’s why a healthy credit score is a must-have if you want to seize those chances without unnecessary hurdles.

Let’s face it, nobody wants to be turned away when they’re itching to buy a dream car or upgrade to a bigger apartment. But if your score isn’t up to par, that’s exactly what can happen.

A strong score can get you better interest rates, smoother loan approvals, and fewer headaches all around.

If you stick to these habits consistently, your financial profile will improve before you know it. Let’s jump in and explore what you can do to walk into your bank with confidence and breeze through the credit-check process.

Pay Your Bills on Time

Timely bill payments are the foundational step to improve the AECB credit score . When you miss a due date or let your account fall behind, it sends a red flag to lenders that you might not be a reliable borrower.

The easiest way to avoid this is to set up automated payments. Many banking apps let you schedule monthly transfers, so you never have to think about it again.

If automation makes you uneasy, put calendar reminders in your phone. Late payments can stick around in your credit report for years, so it’s worth making sure they never happen in the first place.

Another trick is to prioritize which bills absolutely cannot be late. Mortgage or rent, car loans, and credit card statements are at the top of the list.

By managing deadlines effectively, you show the credit bureau and future lenders that you can handle financial responsibilities. It’s a simple step, but consistency is to improve the AECB credit score.

Reduce Your Credit Utilization Ratio

You might have heard that 30% is the magic benchmark for credit utilization. This means you shouldn’t use more than 30% of the limit on any given credit card or line of credit.

For instance, if your credit limit is AED 10,000, try to keep your balance below AED 3,000. High utilization signals that you’re stretched too thin, which drags down your credit score.

The less you use, the more stable and trustworthy you look. One approach is to pay down existing balances aggressively.

If you have multiple cards, focus on clearing the one with the highest interest rate first, then move on to the next. You could also ask for a limit increase.

Just remember, a higher limit is only helpful if you don’t max it out again. Reducing credit utilization pays off big time in your AECB score calculation, and it’s especially beneficial in the long run when you’re eyeing major loans.

Monitor Your Credit Report Regularly

Ever spotted a random charge on your credit card that wasn’t yours? Errors like that can slip into your AECB credit report, and if they’re left uncorrected, they can tank your score.

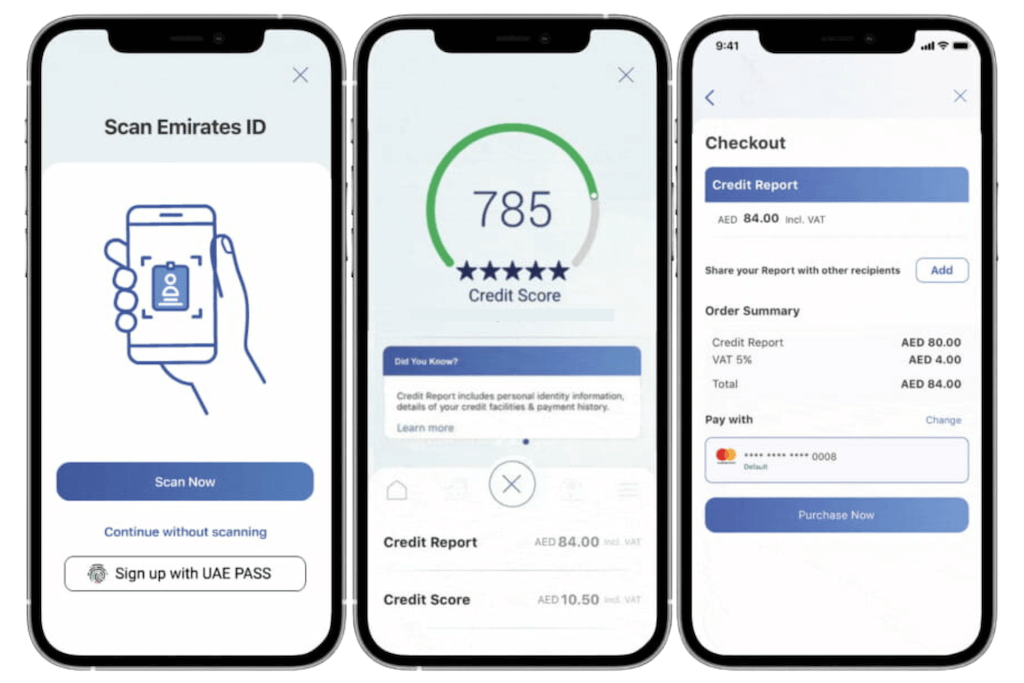

Checking the AECB Credit Report at least once or twice a year helps you catch inaccuracies before they do lasting damage.

It costs AED 84 per report and it includes:

- A detailed record of both your current and past credit accounts

- Your payment history over the last five years

- Any outstanding or overdue payments

- Documentation of payment defaults and instances of bounced cheques

You can visit AECB’s official website or use their mobile app to pull your credit report. It’s straightforward, and you’ll see everything lenders see.

If you do spot something off, dispute it right away. The sooner you address wrong information, the faster you can correct it.

Maintain a Diverse Credit Mix

Using different types of credit responsibly can actually work in your favor. If you only have one credit card, that’s not necessarily bad, but a mix of credit cards, car loans, and maybe a personal loan (if needed) shows lenders you can juggle multiple forms of debt.

That said, you don’t want to take on unnecessary debt just to diversify. Only borrow when it makes sense and you can handle the monthly payments without stress.

Think of credit mix as your way of saying, “Hey, I can handle different types of financial obligations, all at the same time.”

Whether it’s a fixed-term loan or a revolving credit line, the variety looks good on your report if you keep everything in good standing.

This point alone won’t skyrocket your score overnight, but combined with consistent on-time payments and low utilization, it forms a powerful trio that lenders appreciate.

Limit New Credit Applications

Picture this: You walk into five different stores and apply for a credit card at each one in the span of a week. That’s a lot of hard inquiries on your credit report.

Every time you apply for credit, lenders run a check, which temporarily lowers your score. Too many new applications in a short window can make you look risky, as though you’re desperate for quick cash or you’re about to overspend.

Keep things simple. Only apply for credit when you really need it, and don’t jump on every enticing offer out there.

If you plan to shop around for a mortgage or car loan, it’s best to do it within a short timeframe so those inquiries count as one, lessening the impact on your score.

This measured approach to new credit helps keep your AECB score looking healthy and stable.

Keep Old Credit Accounts Open

Closing your oldest credit card might feel satisfying—especially if you don’t use it anymore—but it can actually hurt your AECB credit score.

Part of your score depends on credit history length. When you shut down an old account, you shorten your overall credit age, which can bump your score down.

Plus, eliminating an unused card removes an available credit line, which can increase your utilization ratio if you still carry balances on other cards.

Instead, keep those older accounts open. Use them occasionally for small purchases so they don’t go dormant. Then pay off the balance on time.

This approach maintains your long credit history and boosts that part of your AECB score calculation.

Don’t cut off a stable, aged account just because you think it’s no longer useful. Sometimes, keeping things as they are works out best in the long run.

Consider Becoming an Authorized User

If you’re just starting out or your credit took a major hit, becoming an authorized user on someone else’s card can give you a helping hand.

You tap into the primary cardholder’s good credit history, which can reflect positively on your own report. But keep in mind, this is a big favor to ask.

You’ll want to choose a trusted friend or family member who pays on time and doesn’t rack up huge balances.

As an authorized user, you don’t have the same responsibility as the primary account holder, but you do get the benefit of their positive payment history.

This relationship can speed up your credit-building process, but it also comes with risks. If the primary account holder misses payments or maxes out the card, that can hurt you. So make sure it’s someone responsible and well-disciplined with their finances.

A well-managed authorized user setup can nudge your AECB score in the right direction quickly.

Use a Secured Credit Card

Let’s say your credit history is really minimal or you’re bouncing back from some rough patches. A secured credit card can be your stepping stone.

With a secured card, you put down a cash deposit as collateral, which usually sets your credit limit. The benefit here is you’re using a real credit product—so your payment habits get reported to AECB—and you can prove you’re financially responsible.

Keep your usage low, make on-time payments, and watch your credit rating climb. Over time, you might qualify for an unsecured card that doesn’t require a deposit.

Secured cards aren’t glamorous, but they do the job well when you’re rebuilding or establishing credit. Treat it like training wheels for your financial journey. Once you demonstrate good habits, you’ll move on to bigger and better credit opportunities.

Pay Off Existing Debts

Lingering debt can be a huge drag on your credit score, not to mention a source of stress. Whether it’s credit card balances, personal loans, or overdue bills, focus on reducing them in an organized way.

One approach is the debt snowball method: start by fully paying off the smallest debt, then move on to the next, and so forth.

Another is the debt avalanche, which targets the highest interest rate first. Either way works if you stay consistent.

Sometimes a debt consolidation loan helps, especially if it has a lower interest rate than your existing debts.

You can also explore balance transfers, but be careful with fees and promotional periods. Eliminating or minimizing debt not only improves your credit utilization ratio but also frees up cash for other goals.

With your balances shrinking, you’ll see your AECB credit score improving, giving you a sense of relief and more financial freedom.

Maintain a Healthy ESR and DTI Ratio

Your debt-to-income ratio (DTI) measures how much of your monthly income goes toward paying off debt. Lenders look closely at this because they want to know if you can handle additional loans.

A high DTI suggests you’re already carrying too much. As per the UAE Central Bank regulations, your Debt Burden Ratio (DBR) cannot exceed 50% to qualify for additional financing.

In simple terms, only half of your income can be allocated to servicing debts. Banks assess your credit score to calculate your DBR before approving financing. For pensioners, the DBR limit is set at 30%.

To keep this ratio at a comfortable level, be mindful of taking on new debt. If you’re looking to buy a house or car soon, try to clear some existing obligations first. The lower your DTI, the more room you have to breathe financially.

As of 2023, the AECB has introduced an expense-to-salary ratio in credit reports, providing a more comprehensive view of an individual’s financial health. It’s important that you keep a watch on this too.

Lenders in the UAE pay special attention to these numbers, and if they think your plate is too full, they’ll be reluctant to extend new credit. A healthy DTI shows that you’re not living on the edge, which naturally makes your profile look more secure and creditworthy.

Importance of Improving the AECB Credit Score

A good AECB credit score isn’t just a fancy number. It can help with:

- Better Employment Opportunities: Some employers may review credit scores as part of the background check process, especially for positions involving financial responsibility

- Loan and Credit Card Approvals: Higher scores increase the likelihood of loan and credit card approvals.

- Interest Rates: Individuals with higher scores often qualify for lower interest rates on loans and credit cards.

- Credit Limits: A good score can lead to higher credit limits and more favorable borrowing terms8.

Throughout this guide, we’ve highlighted ten proven strategies: timely payments, keeping your balances in check, reviewing your credit report, diversifying your credit, avoiding too many new applications, keeping old accounts open, leveraging authorized user status, using secured credit cards, paying off existing debts, and maintaining a solid debt-to-income ratio.

Each action, while simple, adds up over time.

The key is consistency. Don’t expect your score to jump overnight. It’s a slow and steady race, especially if you’re making up for past missteps.

But follow these steps, keep an eye on your credit report, and pay attention to how you manage your finances daily.

With patience and determination, you can definitely improve the AECB credit score, opening doors to financial opportunities you might’ve thought were out of reach. Good luck on your journey to a better score in 2025 and beyond!