If you plan on starting a new business in Dubai, there are several things that you need to know before diving in. Dubai has become a hub for businesses from all over the world, thanks to its strategic location, favorable business environment, and tax incentives for incorporation.

However, starting a business in Dubai can be challenging if you are not familiar with the local laws, regulations, and culture.

Before you start your business in Dubai, you need to do your homework and understand the local market, competition, and customer preferences.

This article will provide you with an overview of 9 things that you need to know before starting a business in Dubai. These tips will help you make informed decisions, avoid common pitfalls, and set yourself up for success.

1. Legal Requirements

Prior to registering a business in Dubai, there are a few legal requirements that you must fulfill. These requirements will vary depending on the type of business you plan to open, but there are a few general requirements that apply to all new businesses.

Business Licenses

One of the most important legal requirements for starting a business in Dubai is obtaining a business license. The type of license you need will depend on the nature of your business.

The Department of Economic Development (DED) is responsible for issuing business licenses in Dubai, and they offer several different types of licenses:

- Commercial License: Required for businesses engaged in trading activities.

- Professional License: Required for businesses engaged in professional services.

- Industrial License: Required for businesses engaged in manufacturing activities.

- Tourism License: Required for businesses engaged in tourism activities.

It is important to obtain the correct type of license for your business to avoid any legal issues in the future.

Visas and Work Permits

If you plan to hire employees for your new business, you will need to obtain visas and work permits for them. The process for obtaining these documents can be complex, so it is important to work with a reputable immigration consultant or legal firm to ensure that you follow all the necessary steps.

Additionally, if you plan to work in Dubai yourself, you will need to obtain a residency visa. This can be done through the Dubai Immigration Department or through a sponsor.

It is important to note that there are restrictions on the number of visas and work permits that can be issued for a new business. This is something to keep in mind when planning your business operations.

By fulfilling these legal requirements, you can ensure that your business is operating legally and avoid any potential legal issues in the future.

Dubai offers many business opportunities, and by following the necessary legal steps, you can take advantage of these opportunities and succeed in your new venture.

2. Business Setup Options

When it comes to setting up your business in Dubai, you have several options to choose from. Each option has its own advantages and disadvantages, so it’s important to understand them before making a decision.

The two main types of business setups in Dubai are Free Zone and Mainland Companies.

Free Zones

Free Zones are designated areas in Dubai where businesses can operate with 100% foreign ownership, without the need for a local sponsor.

They offer a range of benefits, including tax exemptions, 100% repatriation of profits, and no currency restrictions. Free Zones are ideal for businesses that plan to import and export goods, as they offer easy access to ports and airports.

There are over 40 Free Zones in Dubai, each with its own focus and regulations. Some of the most popular Free Zones for business opportunities in Dubai include Dubai Multi Commodities Centre (DMCC), Dubai Silicon Oasis (DSO), and Dubai International Financial Centre (DIFC).

Mainland Companies

Mainland Companies are businesses that are registered and licensed by the Department of Economic Development (DED) and are allowed to operate anywhere in Dubai.

Unlike Free Zones, Mainland Companies require a local sponsor if you are registering an LLC. They will who hold at least 51% of the company’s shares. This however does not apply to a professional license.

The local sponsor can be an individual or a company, and they are responsible for obtaining the necessary permits and licenses.

Mainland Companies offer several advantages, including the ability to do business with the local market, access to government contracts, and no restrictions on the number of visas that can be issued. They are ideal for businesses that plan to operate in the local market or provide services to government entities.

| Free Zones | Mainland Companies |

|---|---|

| 100% foreign ownership | Local sponsor required |

| Tax exemptions | No tax exemptions |

| 100% repatriation of profits | Profits can be repatriated subject to certain conditions |

| No currency restrictions | Currency restrictions apply |

| Ideal for import/export businesses | Ideal for businesses targeting the local market |

Choosing the right business setup option is crucial for the success of your business in Dubai. Consider your business goals, target market, and budget before making a decision.

3. Corporate Structure

Choosing the Right Structure

When it comes to setting up a business in Dubai, choosing the right corporate structure is crucial. This decision will determine how successful your business will be.

There are several options available, including sole proprietorship, civil, limited liability company (LLC), and free zone company. Each structure has its pros and cons, and it’s important to carefully evaluate your options before making a decision.

Ownership Restrictions

One of the primary considerations when choosing a corporate structure in Dubai is ownership restrictions. In the past, foreign investors were required to have a local partner or sponsor to set up a business in Dubai.

However, recent changes to the law have made it easier for foreigners to own and operate businesses in the city. Free zones, in particular, offer 100% foreign ownership and provide several business opportunities in Dubai.

It’s important to note that ownership restrictions may still apply in certain sectors, such as banking and finance.

Before deciding on your corporate structure, it’s important to research any ownership restrictions that may apply to your industry.

4. Taxation

When considering business opportunities in Dubai, it is important to understand the tax incentives and regulations that come with operating in the UAE. Here are some key points to keep in mind:

Corporate Tax

The United Arab Emirates’ Ministry of Finance announced on January 31, 2022, that a new federal corporate tax system will be implemented in the country starting from June 1, 2023. The new system will have a standard rate of 9%, which is the lowest corporate income tax rate in the GCC region except for Bahrain.

This marks a significant change in the tax landscape of the region.

Value Added Tax (VAT)

As of 2018, the UAE implemented a 5% VAT on goods and services. This is a relatively low tax rate compared to other countries, and it is important for businesses to understand how it affects their operations.

Businesses that exceed an annual turnover of AED 375,000 are required to register for VAT, and it is important to keep accurate records of all transactions to ensure compliance with VAT regulations.

Overall, the tax incentives and regulations in Dubai make it an attractive location for businesses looking to maximize profits and expand their operations.

With a relatively low VAT rate, businesses can take advantage of the favorable tax environment and focus on growing their business.

5. Labor Laws

When starting a business in Dubai, it is important to understand the labor laws that govern employment in the UAE.

The UAE has recently issued Federal Law No. 33 of 2021, which will take effect on February 2, 2022, and will repeal UAE Federal Law No. 8 of 1980 (the Current Labor Law). Here are some key things to keep in mind:

Employment Contracts

All employees in Dubai must have a written employment contract that outlines their job duties, compensation, and benefits.

The contract must be in Arabic and must comply with the labor laws of the UAE. It is important to note that employment contracts in Dubai are typically for a fixed term, which can range from one to three years.

Employers must renew the contract at the end of the term if they wish to continue employing the worker.

Wages and Benefits

The UAE has a minimum wage law that sets the minimum wage for unskilled workers at AED 2,000 per month.

Skilled workers may be paid more, depending on their qualifications and experience. Employers must also provide their employees with basic benefits, such as health insurance and paid vacation time.

It is important to note that the UAE does not have a social security system, so employers are not required to contribute to a pension fund for their employees.

When considering business opportunities in Dubai, it is important to keep in mind the labor laws that govern employment in the UAE.

Employers must comply with these laws to avoid penalties and legal issues. By understanding the labor laws and ensuring compliance, businesses can create a positive work environment and attract and retain talented employees.

6. Stable Economy

Dubai has one of the most stable economies in the world, making it an ideal location for entrepreneurs to start a business. The city’s economy is driven by various sectors such as tourism, real estate, and finance, which offer a wide range of business opportunities in Dubai.

Currency Pegged to the US Dollar

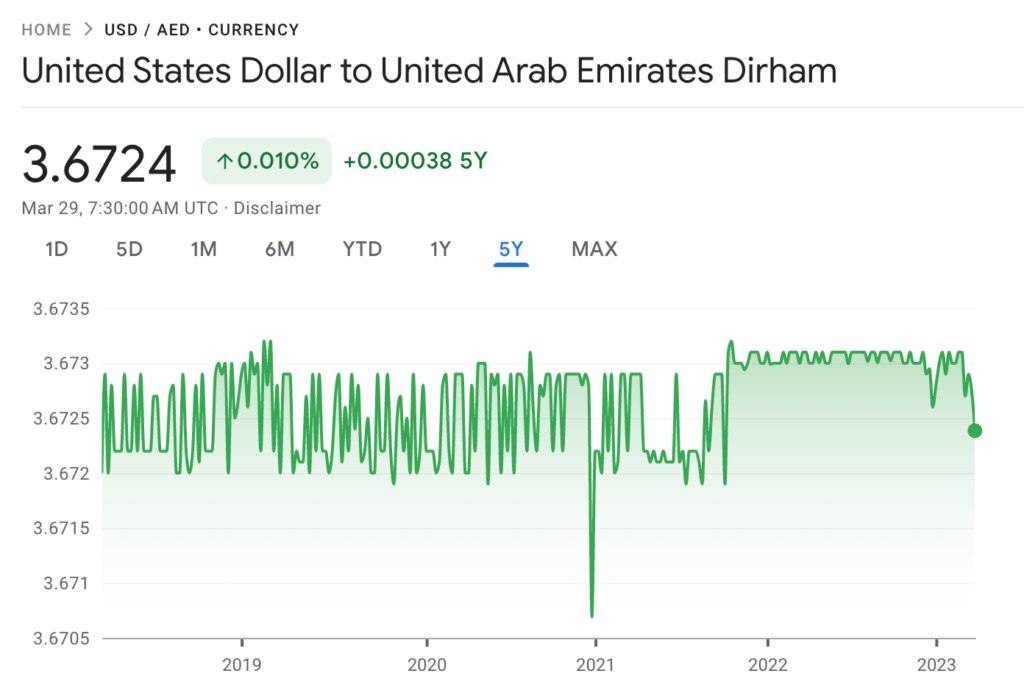

The UAE dirham is pegged to the US dollar, which means that the exchange rate is fixed at AED 3.67 per US dollar.

This provides stability and predictability for businesses operating in Dubai, as they do not have to worry about fluctuations in exchange rates.

Additionally, the currency peg makes it easier for businesses to conduct transactions with international partners, as the US dollar is widely accepted around the world.

Supportive Government

The government of Dubai is known for its pro-business policies, which make it easier for entrepreneurs to set up and run a business in the city.

The government has implemented various initiatives to attract foreign investment, such as offering tax incentives and providing a favorable regulatory environment.

Additionally, the government has invested heavily in infrastructure, which has helped to create a business-friendly environment in Dubai.

Overall, the stable economy, currency pegged to the US dollar, and supportive government make Dubai an attractive location for entrepreneurs looking to start a business.

With a wide range of business opportunities available in various sectors, Dubai is a great place to launch a new venture.

7. Business Culture

Language

The official language of Dubai is Arabic, but English is widely spoken and understood in the business world. English is the language used in most business transactions, so it is important to have a good command of the language.

However, it is always a good idea to learn a few Arabic phrases to show respect for the local culture and make a good impression.

Dress Code

The dress code in Dubai is conservative, especially in the business world. Men should wear suits and ties, while women should dress modestly, covering their shoulders and knees.

It is also important to avoid wearing anything too revealing or tight. This dress code applies not only to meetings but also to office and business events.

It is important to note that Dubai is a multicultural city, and there is a level of tolerance for different dress codes. However, it is always better to err on the side of caution and dress conservatively to avoid any misunderstandings or offense.

Understanding the language and dress code in Dubai is essential to building relationships and making a good impression in the business world.

By respecting the local culture and customs, you will open up more business opportunities in Dubai.

8. Real Estate

Office Space

When starting a new business in Dubai, it is important to consider the cost of renting office space. The cost of office space in Dubai can vary greatly depending on the location and size of the office.

It is important to research the different areas in Dubai to find the best location for your business. Some popular areas for office space include Downtown Dubai, Business Bay, and Dubai Silicon Oasis.

Another option to consider is renting office space in a free zone. Free zones in Dubai offer many benefits for businesses, including 100% foreign ownership and tax exemptions.

However, the cost of renting office space in a free zone can be higher than renting in other areas of Dubai.

Commercial Property

If your business involves buying and selling commercial property, it is important to be aware of the regulations and requirements in Dubai. The Real Estate Regulatory Authority (RERA) oversees the real estate market in Dubai and requires all real estate brokers to be licensed.

Before starting a business in Dubai, you will need to pass the Certified Training for Real Estate Brokers course with RERA. Once you have passed the course, you will be issued a permit and can start trading in the real estate market.

It is also important to research the different areas in Dubai to find the best locations for commercial property. Some popular areas for the commercial property include Dubai Marina, Jumeirah Lake Towers, and Dubai Investment Park.

When buying and selling commercial property in Dubai, it is important to work with a reputable real estate agent who is knowledgeable about the market. This can help ensure that you get the best deals and avoid any legal issues.

9. Marketing and Advertising

Marketing and advertising are essential for any business to succeed, and Dubai is no exception. The city offers a range of business opportunities, and you need to make sure that your business stands out from the competition. Here are some tips to help you market and advertise your business effectively in Dubai:

- Identify your target audience: Dubai is a diverse city with people from all over the world. It is essential to identify your target audience and tailor your marketing and advertising strategies accordingly. Consider factors such as age, gender, income, and lifestyle when identifying your target audience.

- Use social media: Social media is a powerful tool for marketing and advertising in Dubai. It is an excellent way to reach a large audience quickly and cost-effectively. Make sure to create a strong social media presence for your business on platforms such as Facebook, Instagram, and Twitter.

- Partner with influencers: Influencer marketing is a popular trend in Dubai. Partnering with influencers can help you reach a larger audience and increase brand awareness. Make sure to choose influencers who align with your brand values and have a strong following in your target audience.

- Attend events and exhibitions: Dubai is known for its events and exhibitions, and they are an excellent opportunity to showcase your business. Attend relevant events and exhibitions to network with potential customers and partners and increase brand visibility.

Remember that marketing and advertising are ongoing processes, and you need to keep updating your strategies to stay ahead of the competition. By using these tips, you can create a strong marketing and advertising plan for your business in Dubai and increase your chances of success.

Conclusion

Starting a business in Dubai can be a great opportunity to tap into the Middle Eastern market. With its strategic location, stable political environment, and business-friendly policies, Dubai has become a hub for international trade and commerce.

By following the ten things to know before starting a business in Dubai, you can increase your chances of success and avoid potential pitfalls. Dubai offers tax incentives, a favorable business environment, and access to a diverse customer base.

However, it’s important to do your research and plan carefully to ensure that your business is well-positioned to succeed.

With its thriving economy, diverse population, and strategic location, Dubai offers a wealth of business opportunities in various sectors, including tourism, hospitality, real estate, finance, and technology. Whether you’re a startup or an established business looking to expand, Dubai can be an attractive destination to consider.

Overall, Dubai’s business-friendly policies, strategic location, and diverse market make it an attractive destination for entrepreneurs and businesses looking to tap into the Middle Eastern market.

By understanding the 9 things to know before starting a business in Dubai, you can take advantage of the opportunities and maximize your chances of success.